Slovakia's Decline: The Worst in the EU - What's Behind the Slump? by Yusuf Azizullah GBAC and Boardroomeducation.com CEO

Board Alert: Slovakia Stock Market Struggles

Courtesy Tradingecnomic.com

Dear board members & friends,

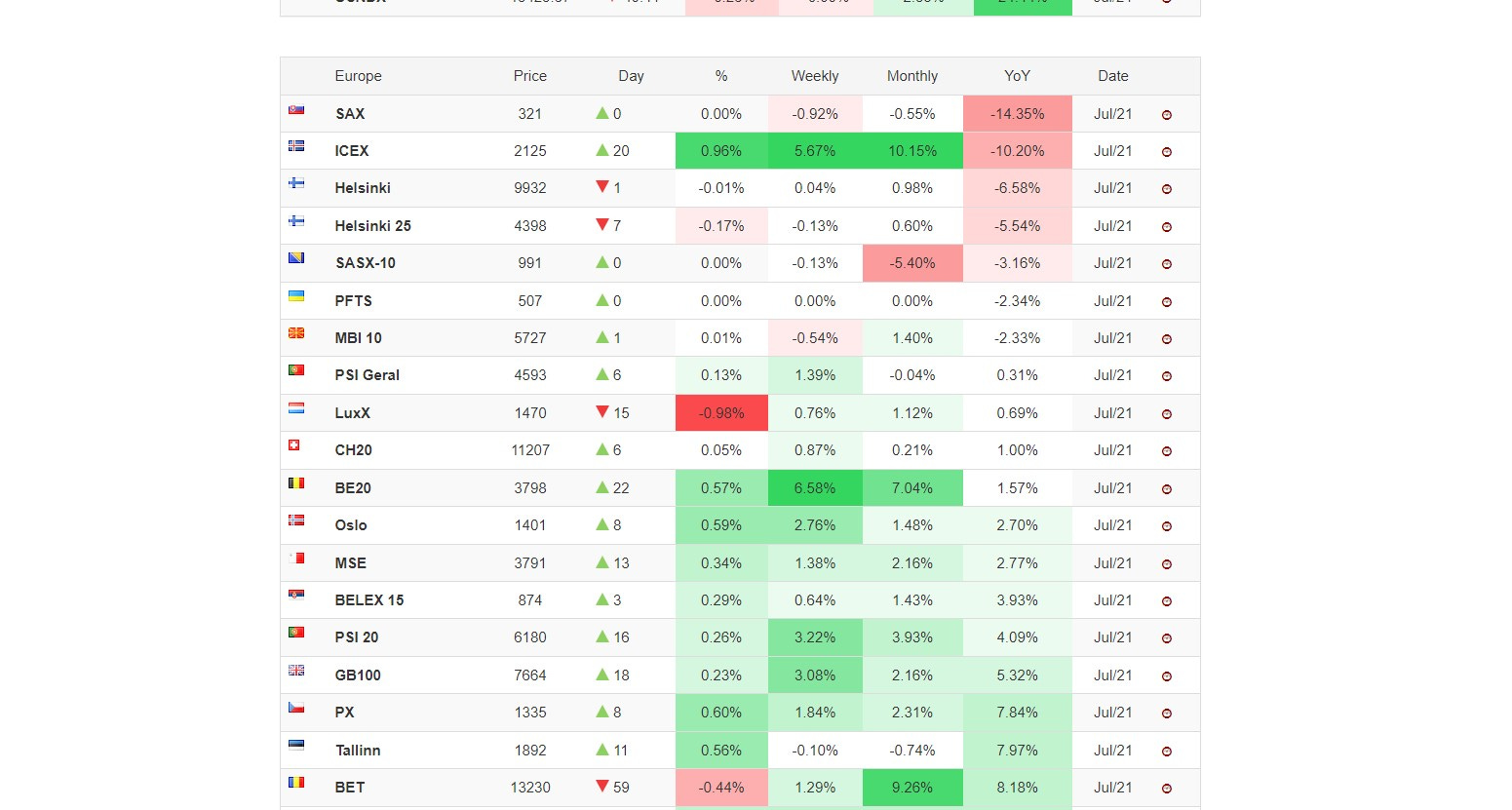

I am writing to you today to talk about the Slovakia Stock Market (SAX) performance. As you know, the SAX has been underperforming other European stock markets in recent months, worst in the EU!!!

Several factors are contributing to SAX's poor performance. These include:

The war in Ukraine

The global economic slowdown

Political Uncertainty in Slovakia; eight different prime ministers since 1993

Domination by a few large companies

Lack of liquidity

Key takeaways from the news on the Slovakia Stock Market (SAX)

The SAX index has decreased by 14 points or 4.12% since the beginning of 2023, while the average return for the European markets was 0.25%.

Slovakia's economy heavily depends on exports, especially to Germany, which accounts for about 23% of its total exports. The slowdown in the German economy due to the pandemic and supply chain disruptions has affected the demand for Slovak products, such as cars and machinery.

Slovakia's political uncertainty and instability, which has seen four different prime ministers since 2018, has also weighed on investor confidence and business sentiment. The current coalition government needs help in implementing reforms and tackling corruption.

The SAX index is dominated by a few large companies, such as Slovnaft (oil refining), VUB Banka (banking), and Eset (cybersecurity), which together account for more than 70% of the index weight. This makes the index vulnerable to sector-specific shocks and less diversified than other European indices.

Key takeaways from the news on Slovakia's economy compared to other European countries

Slovakia's gross domestic product (GDP) per capita in 2021 was USD 21,783, lower than the EU average of USD 33,426. Slovakia ranked 61st among the major economies in the world.

Slovakia's inflation rate 2022 was 12.77%, which was higher than the EU average of 9.22%. Slovakia also had a higher perceived corruption index (53) than the EU average (44).

According to the OECD, Slovakia's economy is projected to grow by 1.6% in 2022, 0.5% in 2023, and 2.1% in 2024. High inflation, supply chain disruptions, and weak global demand will hamper the recovery. EU funds will support investment growth.

Slovakia faces medium-term challenges from rapid population aging, which will increase fiscal pressures and reduce potential growth. The OECD recommends pension, health, long-term care, and labor market reforms to extend working lives, improve health outcomes and enhance public spending efficiency.

Things that could be done to improve the SAX

Attracting more foreign investment could improve the SAX. This could be done by making it easier for foreign investors to buy and sell Slovak stocks.

Diversifying the index could improve the SAX. This could be done by adding more small and mid-cap companies to the index.

Improving the transparency of the market could improve the SAX. This could be done by requiring companies to provide more information to investors.

Conclusion

The Slovakia Stock Market (SAX) is facing several challenges, making it difficult for the market to recover. The war in Ukraine, the global economic slowdown, and political uncertainty in Slovakia are all weighing on the market. It is difficult to say when the SAX will recover, but the market will likely continue to struggle in the near term.

However, several things could be done to improve the SAX. If the Slovak government can implement reforms that will enhance the business environment and attract more foreign investment, the market may start to recover.

Reach me if you want to discuss your strategic opportunities and innovation options in the EU region and Slovakia.

Thank you for your time.

Sincerely,

Yusuf Azizullah